How Daani MLM Investment Plan Software Transforms Network-Based Financial Systems

The landscape of modern finance is rapidly evolving, with technology serving as both a disruptor and an enabler. Among the many innovations shaping the industry, network-driven investment platforms stand out for their unique blend of community-based growth and digital automation. These platforms combine the mechanics of multi-level structures with sophisticated MLM investment system, creating a hybrid system where collaboration and financial technology coexist.

In this article, we’ll explore how such software reshapes network-based financial ecosystems, the challenges it solves, its benefits for both organizations and participants, and the trends that will shape its future.

The Changing Face of Financial Networks

Traditional financial systems were built around centralized control—banks, brokers, and large institutions. In contrast, network-based systems decentralize participation, empowering individuals to both contribute and benefit directly. This approach gained traction with the rise of the internet, where communication barriers diminished, and communities could form around shared economic goals.

The introduction of specialized software platforms provided the missing ingredient: a reliable, automated, and transparent way to manage transactions, commissions, and returns. What once required spreadsheets, manual calculations, and blind trust is now supported by real-time dashboards and secure algorithms.

Why Network-Driven Investments Need Digital Solutions

MLM investment plan tools built on community participation face various operational challenges that grow with scale. As networks expand, manual processes become unreliable and open the door to errors. For this reason, many organizations exploring digital transformation also use tools such as mlm programming to maintain smoother internal operations.

-

Accuracy in Financial Records

Each deposit, withdrawal, and reinvestment must be logged with precision. Even minor discrepancies can erode trust.

-

Automated Payouts and Returns

MLM investment system often rely on time-bound returns, which are better managed through scheduled, rule-based automation.

-

Complex Compensation Plans

Investment-driven networks rely on layered payout systems that require advanced calculation tools. Manual methods cannot keep up with dynamic structures or large-scale user activity. In similar industries, platforms like mlm script software help automate these calculations effectively.

-

Security and Compliance

Financial ecosystems are prime targets for fraud. Encryption, two-factor authentication, and audit trails provide much-needed protection.

-

Scalability

As networks grow, operational demands increase and manual processes begin to break down. Scalable software keeps performance stable, even as thousands of new participants join. Many expanding businesses use tools such as mlm matrix script to structure large networks efficiently.

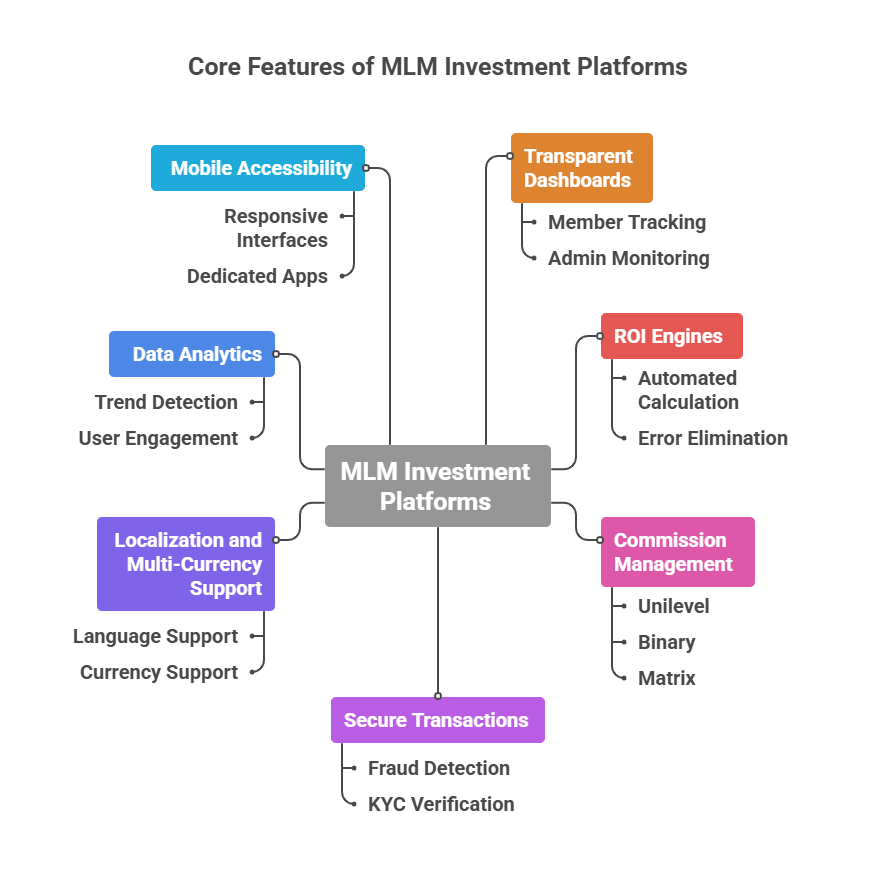

Core Features of Modern Platforms

An effective solution designed for investment-focused networks typically includes a broad suite of features, each addressing a specific business need.

-

Transparent Dashboards

Both members and administrators require visibility. Members want to track earnings and investments, while administrators monitor overall performance, detect issues, and manage compliance. This level of visibility is also expected in mlm back office software environments.

-

ROI Engines

Return on investment is a foundational element of these systems and must be calculated with precision. Automated engines apply pre-defined rules to generate accurate returns at scheduled intervals. Some platforms also incorporate tools similar to mlm marketing mobile apps to improve communication and user engagement.

-

Commission Management

Flexible commission modules support unilevel, binary, matrix, or hybrid structures depending on business strategy. Automation ensures payouts follow exact structural rules without manual intervention. Many network-based businesses also implement revolving matrix mlm software to manage complex and layered workflows efficiently.

-

Secure Transactions

Integration with global and local payment gateways ensures smooth transactions. Fraud detection tools and KYC verification further strengthen security.

-

Localization and Multi-Currency Support

Global networks thrive when users can transact in their own languages and currencies, improving inclusivity and trust.

-

Data Analytics

Reports and performance metrics help administrators evaluate progress and refine strategies as the network evolves. Analytics highlight user behavior, financial trends, and operational bottlenecks. In blended environments, platforms also use tools like mlm closing scripts to maintain consistent communication and workflow efficiency.

-

Mobile Accessibility

With mobile-first usage dominating worldwide, responsive interfaces or dedicated apps ensure users can interact with the system anytime, anywhere. This flexibility mirrors expectations found in home party plan software platforms.

Advantages for Organizations

For organizations, implementing a specialized platform provides numerous strategic benefits. To support cost efficiency in related markets, some organizations also evaluate solutions like low cost mlm software when comparing digital tool budgets.

- Operational Efficiency: Automation minimizes human labor and errors.

- Global Scalability: The system can grow from a few hundred to millions of members without performance loss.

- Credibility: Transparent dashboards and reliable reporting build trust.

- Regulatory Readiness: Audit trails and secure record-keeping simplify compliance.

- Reduced Costs: Fewer errors and fraud incidents save money over time.

Some businesses also prefer exploring a network marketing software demo before making a full commitment, as it helps them evaluate usability and features. Many also look for mlm software low price options during early adoption stages.

Advantages for Participants

For individual members, the experience is equally rewarding:

- Transparency: Real-time updates reduce dependence on middlemen.

- Convenience: Onboarding, tracking, and reinvesting are all streamlined.

- Accessibility: Members can interact with the platform through mobile devices and multiple payment methods.

- Financial Growth: Automated compounding and reinvestment options maximize earnings potential.

Participants often weigh factors like support, reliability, and even network marketing software price. In similar markets, users compare tools such as best network marketing app for decision making and party plan software alternatives.

The Importance of Customization

Not all networks are the same. Some prioritize fast growth, while others focus on stability and longevity. Customization ensures that the platform aligns with business goals. Businesses seeking structured automation sometimes adopt tools like mlm software provider solutions for specialized configurations.

Examples include:

- Tailored ROI Models: Fixed vs. variable returns depending on risk appetite.

- Unique Commission Structures: Beyond standard templates, businesses may design hybrid models.

- Compliance Adjustments: Integration with regional banking laws.

- Branding: Customized interfaces that reflect organizational identity.

Customization isn’t a luxury—it’s a necessity for credibility and differentiation.

Security: The Non-Negotiable Factor

No financial platform can thrive without airtight security. Essential measures include encryption, blockchain records, KYC systems, and AML tools. Some organizations exploring cost-efficient digital ecosystems even compare tools like cheapest mlm software to begin experimentation before scaling, while others prioritize simple mlm software pricing for predictable budgeting.

- End-to-End Encryption for sensitive data.

- Blockchain Records to ensure immutability of transactions.

- Two-Factor Authentication for all logins.

- AML (Anti-Money Laundering) Tools to filter out fraudulent transactions.

- Regular Security Audits to identify and patch vulnerabilities.

Failure in this domain doesn’t just harm finances—it destroys trust, which is irreplaceable.

Emerging Trends

The future of network-based financial platforms is shaped by AI, blockchain, DeFi, gamification, and sustainability. As global digital infrastructure expands, industries also track adjacent markets like the cloud managed network market to understand connectivity demands.

-

Artificial Intelligence

AI-powered analytics predict member churn, identify fraud, and optimize commission plans.

-

Blockchain and Smart Contracts

Immutable records and self-executing agreements ensure transparency and reduce dependence on administrators.

-

Integration with Decentralized Finance (DeFi)

Members can access staking, lending, and liquidity pools directly through the platform.

-

Gamification

Incentives such as badges, leaderboards, and bonus challenges improve member engagement.

-

Green and Ethical Investments

Networks that support eco-conscious investment options appeal to socially responsible investors.

Another rising interest is the availability of free network marketing software, which allows small teams to experiment before investing in premium or customized versions.

Implementation Challenges

Despite the promise, there are real challenges:

- Regulatory Barriers: Varying laws across regions make compliance complex.

- Development Costs: Advanced features like blockchain integration require significant investment.

- Reputation Management: Past controversies around network-based models demand extra transparency.

- User Education: Members must understand investment principles to participate responsibly.

Overcoming these challenges requires transparency, strong governance, and continuous innovation.

If you want to try our software, pleade click on MLM Investment Plan Software.

Human Leadership Matters

Technology provides the infrastructure, but leadership sustains the system. Ethical management, fair distribution, and ongoing training are critical for long-term success. Networks that prioritize people over profits build resilience against market fluctuations and reputational risks.

A Case for Sustainability

Sustainable platforms think long-term. They diversify investments, maintain transparency, encourage reinvestments, and educate their members. When organizations adopt this mindset, they transition from being just financial tools to trusted ecosystems.

Use Case: MLM Investment Software for Network-Based Investment Businesses

Business Scenario

A network-based investment company operating across multiple regions required a secure and automated system to manage member investments, returns, and multi-level commissions. Manual processes and spreadsheets were leading to calculation errors, delayed payouts, and reduced member trust.

Challenges

- Manual tracking of investments and ROI

- Complex multi-level commission calculations

- Delayed and inaccurate payouts

- Limited transparency for members

- Difficulty scaling as the network grew

Solution

The company implemented MLM Investment Software to automate investment tracking, ROI distribution, and commission calculations. The platform provided real-time dashboards for members and administrators, secure transaction processing, and rule-based automation for returns and payouts.

How the Software Was Used

- Members invested and tracked returns through a digital portal

- ROI and commissions were calculated automatically

- Administrators monitored performance using real-time reports

- Secure payment systems ensured accurate and timely transactions

Results

- Faster and error-free ROI and commission payouts

- Improved transparency and member confidence

- Reduced administrative workload

- Scalable operations across regions

- Stronger compliance and reporting control

This use case demonstrates how MLM Investment Software enables secure automation, transparency, and sustainable growth for network-driven investment businesses.

Testimonial

Investment Operations Manager, USA

"Before using this MLM Investment Software, managing investments and returns was extremely difficult. The automation of ROI and commissions eliminated errors and delays. Our members now have complete transparency, which has significantly increased trust in our platform."

— David Michael Johnson

Founder and CEO, USA

"This software gave us the control and scalability we needed to grow our investment network. Real-time dashboards, secure transactions, and accurate payout automation helped us expand without operational stress. It has become the backbone of our business."

— Robert Allen Mitchell

Finance Director, USA

"Our members appreciate the clarity and consistency the system provides. Automated reporting, timely payouts, and easy access to investment details have improved engagement and retention. This MLM Investment Software brought professionalism and long-term stability to our network."

— Jennifer Louise Carter

Conclusion

Network-based investment mlm plan software represents a fusion of technology, finance, and human collaboration. By automating transactions, ensuring transparency, and enabling complex compensation plans, these platforms solve long-standing challenges in scalability, trust, and compliance.

The future promises even greater integration with AI, blockchain, and decentralized finance, expanding possibilities for transparency and growth. Yet, amidst all the innovation, the heart of success remains ethical leadership and sustainable practices.

Such systems are not merely digital solutions—they are catalysts for building communities, expanding financial opportunities, and transforming how people think about investments in the digital era.